Free Strategic Consultation for portfolio enhancement

Preserve Families & Communities. Enhance Returns. Invest with Purpose.

The American Home Preservation Project connects mission-driven capital with families that need help—helping you unlock better performance while keeping families in their homes. Do your homework and explore if our approach aligns with your profit strategy.

No obligation. Limited spots weekly for qualified partners, lenders, and housing-focused organizations.

Specialized in keeping families in their homes

Proven community-preservation and foreclosure defense.

Unusual market beating performance

Request Your Strategy Session

Tell us about your portfolio, mandate, or pipeline. We’ll map how The American Home Preservation Project can support your objectives.

Average response time: under one business day. We never sell or share your information.

Why The American Home Preservation Project

A specialized partner at the intersection of

returns and responsibility.

We focus exclusively on distressed families with residential assets, designing strategies that balance financial performance with tangible impact for homeowners and communities.

Mission Driven Pursuit of Justice

Foreclosure mills are popping up across America creating en epidemic of engineered foreclosures initiated with fabricated non-compliant paperwork.

Aligned with Institutional Standards

Our methods are based solely on established law and accounting standards (GAAP). Our team members are credentialed experts in their field operating at the highest level of their discipline

Impact You Can Measure

How do you measure the impact of saving a family from being thrown out into the street unjustly? Stable homes are where children grow. A stable community is the fabric of a strong America.

Phase I Investigative Services

Cash-Flow Illustration

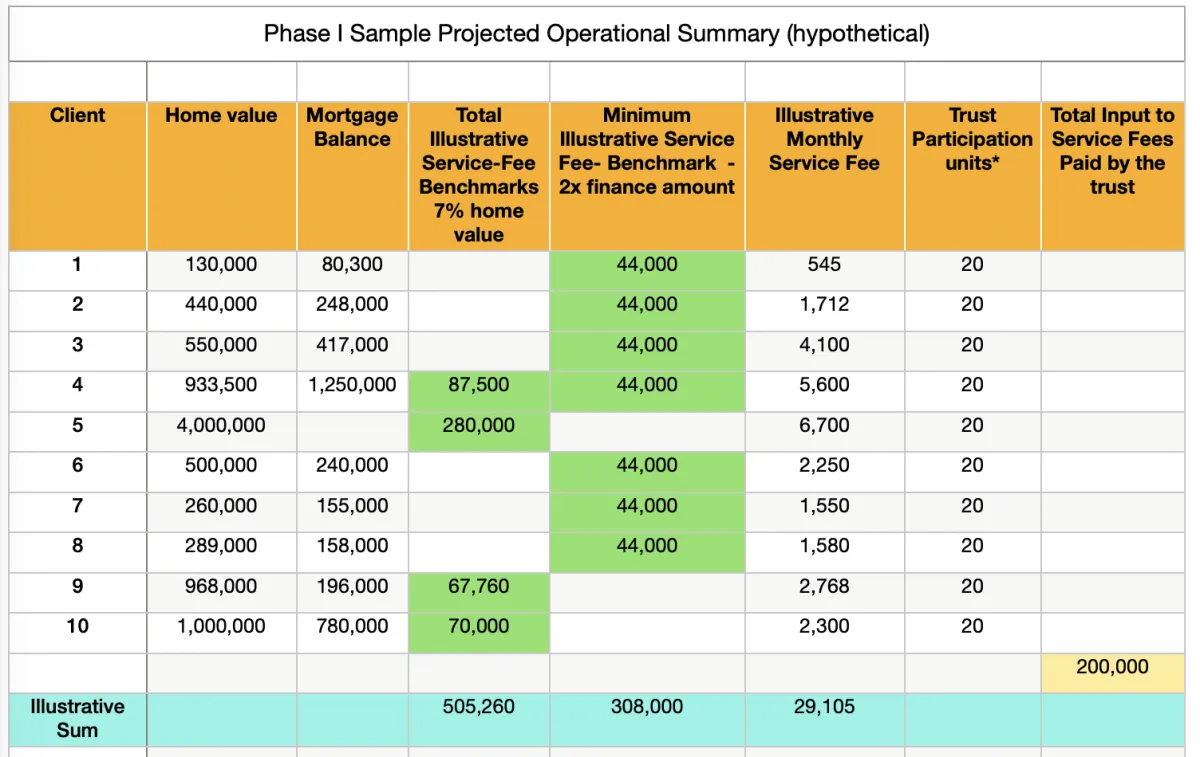

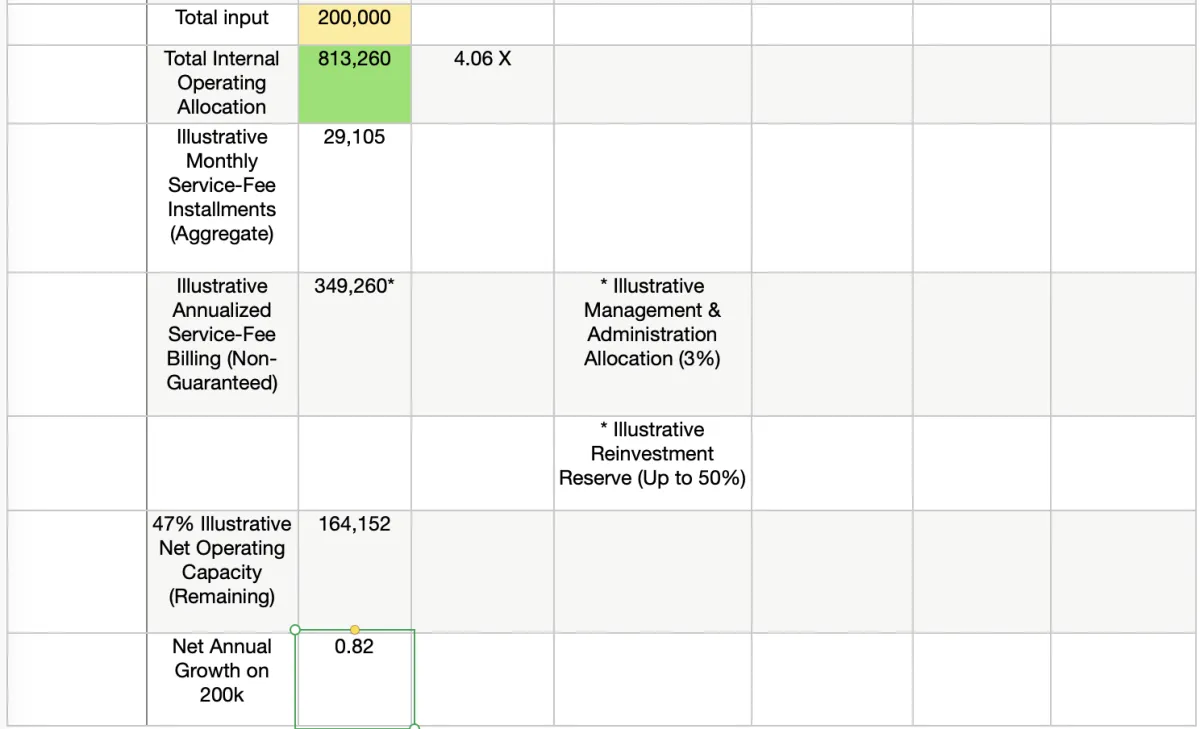

- The Phase I spreadsheet illustrates a cash-flow model derived from fixed-fee investigative service agreements with homeowners facing alleged foreclosure activity.

- The model is designed to provide context for operational sustainability and does not represent lending, investment returns, securitization, or foreclosure outcomes.

- Each entry reflects a separate services agreement with a homeowner.

- Fees are fixed in advance and may be paid in full or through equal monthly installments for billing convenience.

- No interest, finance charges, compounding, or time-based price increases apply.

- Aggregated figures are shown solely to illustrate projected service-fee inflows supporting investigative capacity, staffing, and professional expenses.

- The model excludes assumptions associated with consumer credit, enforcement, penalties, default, or recovery scenarios.

Disclaimer: This spreadsheet reflects fixed-fee investigative services billing only and does not represent a loan, banking activity, investment, security, or guarantee of returns. Figures are illustrative and based on anonymized sample data.

and If the above weren't enough....

Phase II - Collections of Fines, Fees & Penalties

Once the facts are established in Phase I, we expose and document various important issues such as denial of due process, denial of civil rights, non-compliance with federal consumer lending laws, securities law, IRS issues and much more., We have the obvious judicial remedies available and several powerful non-judicial remedies. These amounts are substantial and well within reach which only add to these impressive results..

Federal Law

Problems arise from Truth in Lending, Fair Debt Collections Practices, Securities law and much more..

Uniform Comercial Code

The UCC governs much of banking and finance and is very specific on the governance of transactions. The UCC provides a fertile field to find low hanging fruit for non-compliant activity.

Accounting

The one key issue revolves around GAAP (Generally Accepted Accounting Principles) and the books don't lie. It's in the numbers and this fact assures success.

“Our work is about so much more than how some people profit from others' misfortune, It’s about preserving the fabric of American neighborhoods while meeting the mandates of sophisticated capital.”

— Mark E. Trustee:, The American Home Preservation Project

Book Your Free Consultation

Let’s explore how to align your capital with home preservation.

Share a few details about your role, the size of your portfolio or mandate, and what you’d like to accomplish. Our team will follow up to confirm a time and send a calendar invite.

30-minute video or phone consultation

Tailored to your asset mix and objectives

No obligation. Let's just explore the details and see if this is a fit for you.

Request Your Time Slot

Fill out the brief form linked below and we’ll reach out with available times tailored to your time zone.

By submitting, you consent to be contacted regarding The American Home Preservation Project. You can opt out at any time.